As you navigate through your teenage years, grasping the concept of money becomes increasingly important. Money is not just a means to buy things; it represents the effort and time you invest to earn it. Understanding its value can help you make informed decisions about how to spend, save, and invest.

When you recognize that every dollar has a story—whether it’s the hours spent working at a part-time job or the allowance earned through chores—you begin to appreciate the significance of financial choices. This awareness can empower you to prioritize your needs over your wants, leading to more responsible spending habits. Moreover, understanding the value of money extends beyond mere transactions.

It involves recognizing the impact of inflation, interest rates, and economic trends on your purchasing power. For instance, what you can buy with a dollar today may not be the same in a few years. By educating yourself about these concepts, you can develop a more nuanced perspective on financial matters.

This knowledge will serve you well as you transition into adulthood, where financial literacy becomes crucial for making sound decisions regarding loans, investments, and savings.

Key Takeaways

- Understanding the value of money is crucial for teens to make informed financial decisions.

- Budgeting basics help teens manage their money and prioritize their spending.

- Making smart spending choices involves considering needs versus wants and comparing prices.

- Earning money as a teen can provide valuable financial independence and teach important skills.

- Saving and investing tips can help teens grow their money and prepare for the future.

Budgeting Basics for Teens

Identifying Your Income and Expenses

Start by making a list of all your sources of income, including allowances, part-time jobs, and gifts. Then, categorize your expenses into fixed costs, such as phone bills or subscriptions, and variable costs, like entertainment or snacks.

Setting Realistic Spending Limits

Once you have a comprehensive view of your finances, set realistic spending limits for each category. This doesn’t mean depriving yourself of fun, but rather making conscious choices that align with your priorities.

Benefits of Budgeting

By sticking to your budget, you’ll not only avoid overspending but also cultivate a sense of discipline that will benefit you in the long run. For example, if you love going out with friends but find that it eats into your savings, consider setting aside a specific amount for social activities each month.

Making Smart Spending Choices

As a teenager, the allure of trendy gadgets, fashionable clothes, and spontaneous outings can be overwhelming. However, making smart spending choices is essential for maintaining financial stability. Start by asking yourself whether a purchase is a need or a want.

Needs are essential for your daily life—like food and school supplies—while wants are often fleeting desires that may not provide lasting satisfaction. By distinguishing between the two, you can prioritize your spending and avoid impulse buys that could derail your budget. Another strategy for making wise spending decisions is to practice delayed gratification.

Instead of rushing to buy something as soon as you see it, take some time to think it over. Ask yourself if the item will truly enhance your life or if it’s just a passing fancy. This pause can help you avoid buyer’s remorse and lead to more thoughtful purchases.

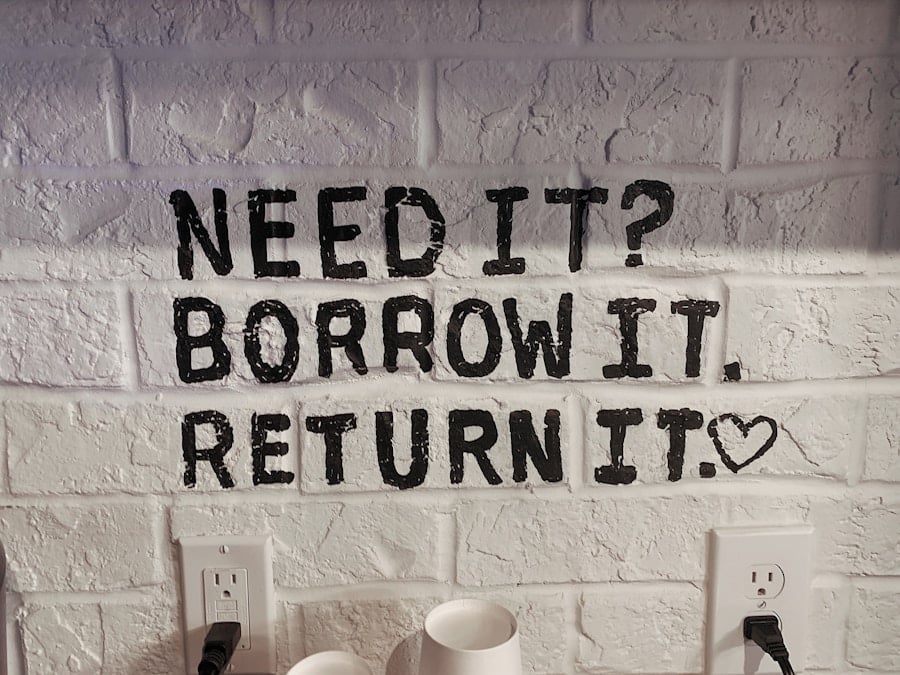

Additionally, consider seeking out alternatives that provide similar satisfaction without breaking the bank—like borrowing books from the library instead of buying them or organizing free activities with friends instead of costly outings.

Earning Money as a Teen

Finding ways to earn money as a teenager can be both rewarding and empowering. Part-time jobs are a popular option; they not only provide income but also valuable work experience that can enhance your resume. Whether it’s working at a local café, babysitting, or tutoring younger students, these opportunities teach you responsibility and time management while allowing you to earn your own money.

Additionally, they can help you develop essential skills such as communication and teamwork. If traditional jobs aren’t appealing or available, consider entrepreneurial ventures that align with your interests. Perhaps you have a knack for graphic design or enjoy crafting handmade jewelry.

You could start a small business selling your creations online or at local markets. Alternatively, offering services like lawn care or dog walking in your neighborhood can be a great way to earn extra cash while building connections within your community. The key is to find something that excites you and allows you to leverage your skills for financial gain.

Saving and Investing Tips for Teens

Saving money is an essential habit that will serve you well throughout your life. As a teenager, it’s never too early to start building your savings account. Aim to set aside a portion of any money you earn—whether from a job or gifts—into savings before allocating funds for spending.

A common rule of thumb is the 50/30/20 rule: allocate 50% of your income for needs, 30% for wants, and 20% for savings. By consistently saving a portion of your earnings, you’ll create a financial cushion that can help you in emergencies or future endeavors. Investing may seem daunting at first, but it’s an excellent way to grow your wealth over time.

While you might not have large sums to invest yet, consider starting with small amounts in low-cost index funds or savings accounts with higher interest rates. Many financial institutions offer youth accounts designed specifically for teenagers, allowing you to learn about investing while earning interest on your savings. Educating yourself about basic investment principles now will set the foundation for more complex financial decisions in the future.

Using Technology to Save Money

In today’s digital age, technology offers numerous tools and resources to help you manage your finances effectively. Budgeting apps can simplify tracking your income and expenses by providing real-time insights into your spending habits. These apps often come with features that allow you to set financial goals and receive alerts when you’re nearing your budget limits.

By leveraging technology in this way, you can stay organized and make informed decisions about your finances. Additionally, online shopping platforms often provide price comparison tools that enable you to find the best deals on products you’re interested in purchasing. Before making any online purchase, take advantage of these tools to ensure you’re getting the best value for your money.

Furthermore, consider using cashback apps that reward you for shopping at certain retailers or completing specific tasks. These small savings can add up over time and contribute significantly to your overall financial health.

Taking Advantage of Teen Discounts and Deals

As a teenager, you’re in a unique position to take advantage of various discounts and deals tailored specifically for young people. Many retailers offer student discounts on clothing, electronics, and even food—simply by showing your student ID or signing up for their loyalty programs. These discounts can significantly reduce costs and allow you to enjoy more while spending less.

In addition to retail discounts, keep an eye out for special promotions aimed at teens in entertainment venues like movie theaters or amusement parks. Many places offer discounted admission prices on certain days or during specific hours. By planning outings around these deals, you can enjoy fun experiences without straining your budget.

Always be on the lookout for opportunities to save; every little bit counts when it comes to managing your finances effectively.

Setting Financial Goals for the Future

Setting financial goals is crucial for guiding your spending and saving habits as a teenager. Start by identifying short-term goals—such as saving for a new phone or funding a summer trip with friends—and long-term goals like saving for college or a car. Having clear objectives will motivate you to stick to your budget and make smarter financial choices.

Once you’ve established your goals, break them down into actionable steps. For instance, if you’re saving for college, research tuition costs and determine how much you’ll need to save each month to reach that target by the time you graduate high school. Regularly review and adjust your goals as needed; life circumstances may change, and being flexible will help you stay on track toward achieving financial success in the future.

In conclusion, understanding money management as a teenager lays the groundwork for lifelong financial health. By learning budgeting basics, making smart spending choices, exploring ways to earn money, saving diligently, utilizing technology effectively, taking advantage of discounts, and setting clear financial goals, you’re equipping yourself with essential skills that will serve you well into adulthood. Embrace this journey with enthusiasm; the habits you cultivate now will shape your financial future in profound ways.

If you’re looking for more ways to save money as a teenager, you may want to check out this article on teenage ways to make money. This article provides various ideas and tips on how teenagers can earn extra cash through different avenues. Whether it’s starting a small business, doing odd jobs, or selling items online, there are plenty of opportunities for teenagers to make money and start saving for the future.

FAQs

What are some ways for teenagers to save money?

Some ways for teenagers to save money include creating a budget, avoiding impulse purchases, finding part-time jobs, and taking advantage of student discounts.

Why is it important for teenagers to save money?

It is important for teenagers to save money to develop good financial habits, prepare for future expenses such as college or a car, and to have a safety net for emergencies.

What are some tips for creating a budget as a teenager?

Some tips for creating a budget as a teenager include tracking expenses, setting savings goals, prioritizing needs over wants, and finding ways to cut costs.

How can teenagers avoid impulse purchases?

Teenagers can avoid impulse purchases by creating a shopping list, waiting 24 hours before making a purchase, and considering the long-term value of the item.

What are some part-time job options for teenagers?

Some part-time job options for teenagers include working at retail stores, restaurants, tutoring, babysitting, pet sitting, and doing odd jobs for neighbors.

How can teenagers take advantage of student discounts?

Teenagers can take advantage of student discounts by showing their student ID at participating stores, restaurants, and entertainment venues, and by signing up for student discount programs.